RMB Exchange Rate Trend in 2023

The outlook for the RMB exchange rate trend in 2023 is that the economies of China and Europe and the US may show misaligned development in 2023. Driven by the optimization of epidemic prevention and control measures, the Chinese economy is expected to accelerate its return to normality, while the economies of Europe and the US may fall into recession, and the misalignment of the Chinese and foreign economic cycles will bring support to the RMB exchange rate, which is expected to maintain a stable to strong trend.

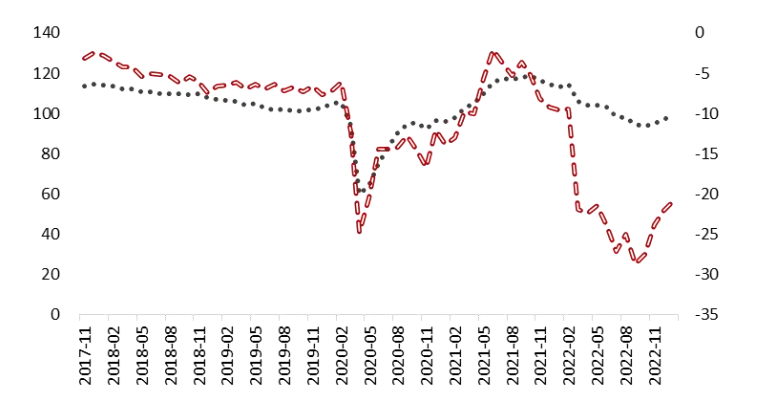

(A) Economic growth trend dislocation will bring support to the RMB exchange rate in 2023, the global economy will show a downward trend, inflation cooling growth trend, the economy of Europe and the United States may fall into the "high inflation, high interest rates, low growth" dilemma. In November 2022, the Institute for Supply Management (ISM) manufacturing PMI fell to 49%, the first time since May 2020 to fall below the Rong Kuk line, and has since declined continuously, further falling to 47.4% in January 2023. In January 2023, it fell further to 47.4%. At the same time, cooling consumption and weak investment in the U.S. were further highlighted, with personal durable goods and non-durable goods consumption growth falling to 3.2% and 5.65%, respectively, year-over-year in December 2022, and residential and non-residential investment falling to -26.7% and 0.7%, respectively. Against the backdrop of slowing economic growth momentum, layoffs are increasing in the financial, retail, manufacturing, and transportation sectors in the U.S. Since the beginning of 2023, many prominent U.S. companies, such as Goldman Sachs, Microsoft, IMB, Boeing, ebay, Disney, and other industry giants have also announced layoffs, further fueling concerns about the U.S. economic outlook from all sectors.

Looking at the situation in Europe, the contradiction between energy supply and demand brought about by the Ukraine crisis will still bring about a shock to the European economy, while the ECB's sharp interest rate hike has caused harm to the real economy while curbing the rapid upward movement of prices. Eurostat released data showing that the eurozone economy grew 0.1% qoq and 1.9% y-o-y in the fourth quarter of 2022, and the EU economy grew zero qoq and 1.8% y-o-y in 2023, Issue 16 (Total 471) 10. Although the unusually warm weather partially mitigated the impact of the energy crisis, while increased fiscal support in many EU countries prevented the economy from falling into recession, the economies of many EU member states remain stagnant with near-zero growth, the outlook for economic growth is gloomy, and the economic sentiment and consumer confidence indices remain weak. Germany and Italy, in particular, were more severely affected by the energy crisis, and their economies contracted mildly in the fourth quarter of last year, with Germany's GDP falling by 0.2% in the fourth quarter of last year, while France and Spain barely managed to maintain modest growth. On the whole, under the influence of multiple factors such as continued weak consumption and investment, tight labor market, tight liquidity environment and continuing geopolitical conflicts, it is difficult to reverse the declining trend of economic growth in Europe and the United States in 2023, and it is probable that major economic indicators will weaken, The risk of stagflation will rise, and we may fall into the predicament of "high inflation, high interest rate, low growth".

In China, consumption and investment confidence are recovering, driven by the optimization of epidemic prevention and control measures, and the endogenous momentum of economic growth continues to strengthen. manufacturing PMI rose to 50.1% in January 2023, and enterprises' expectations for the future economy are warming. The IMF's latest forecast for January 2023 also raised China's economic growth forecast to 5.2% from 4.4% previously. Against the backdrop of the economic downturn in Europe and the US and the steady improvement in China's economy, the mismatch in economic development will bring greater support to the RMB exchange rate.

(B)Although inflation in Europe and the U.S. is still at a high level, it has entered a downward path. inflation in Europe and the U.S. has basically been in a continuous decline since the second half of 2022, with the U.S. CPI and core CPI falling to 6.4% and 5.6% in January 2023 and the Eurozone CPI falling to 8.5%, the lowest since June 2022. The Eurozone CPI has fallen to 8.5%, the lowest since June 2022. In the context of easing inflationary pressure, the pace of monetary policy tightening in Europe and the U.S. began to slow down significantly. in February 2023, the Federal Reserve announced a 25 basis point increase in the target range for the federal funds rate to 4.50%-4.75%, and it is expected that the Fed will suspend the current round of rate hikes after another 25BP hike in March. According to the Fed's forecast, the U.S. unemployment rate is expected to be 4.4% in 2023, compared to the last forecast of 3.9%. If there is a recession in the U.S. economy and the unemployment rate continues to rise, the Fed is not ruled out to take measures to cut interest rates. Looking at the situation in Europe, as the eurozone price recession lagged compared to the U.S., the ECB announced in February that the three key interest rates in the eurozone were raised by 50 basis points, and is expected to raise rates further thereafter to ensure that inflation falls back to the 2% medium-term target level in a timely manner, but the economic downturn in the eurozone is difficult to bring a significant boost to the euro. Overall, in the context of easing external liquidity conditions, the US dollar index may top out, the euro is difficult to see significant strength, and the external environment facing the RMB exchange rate will improve significantly.

(C) China's balance of payments is expected to remain stable and the recognition of RMB by foreign investors is steadily increasing On the one hand, China's export trade is facing certain challenges. since the second half of 2022, the growth rate of China's exports has significantly slowed down and has fallen to -9.9% (in USD terms) in December 2022. According to the Ministry of Commerce, the main contradiction in China's foreign trade sector has changed from a blocked supply chain and lack of performance capacity in 2022 to weaker external demand and declining orders in 2023. Against the backdrop of the global economic downturn, the decline in external demand will affect the scale of China's exports and put the current account under increased pressure. But on the other hand, the capital and financial account is expected to continue to improve. According to the Bank for International Settlements (BIS), in terms of currencies traded in the global foreign exchange market, the RMB has the largest market share expanding from 4.3% to 7%, rising from 8th place in 2019 to 5th place in 2022. The weight of RMB in the Special Drawing Rights (SDR) currency basket has risen to 12.28%, and more than 70 countries have included RMB in their foreign exchange reserves, making RMB the fifth largest reserve currency in the world. RMB assets are recognized by more and more countries and investors. Especially against the backdrop of the economic downturn in Europe and the US, RMB assets have relative advantages, and foreign investors are expected to continue to increase their allocation to RMB assets, which will help China's balance of payments maintain an overall balance, which in turn will support the RMB exchange rate. From the data, as of the end of January 2023, the market value and share of A-shares held by foreign investors were 2.53 trillion yuan and 3.55%, up 433.7 billion yuan and 0.15 percentage point from last October, especially since January, northbound funds have been net buyers for 17 consecutive trading days, and foreign investors are expected to be optimistic about China's capital market. Foreign exchange reserves also grew to $318.4462 billion, the fourth consecutive month of positive growth.

On a consolidated basis, the RMB exchange rate is expected to show an overall two-way fluctuation and a stable to strong trend in 2023. In the first half of the year, the RMB exchange rate will continue its oscillating strong trend since December 2022 under the influence of a combination of factors such as the continued effectiveness of China's epidemic prevention and control measures, the maintenance of an overall balance of payments and the slowing pace of the Fed's interest rate hikes, as the economic upturn is expected to be gradually confirmed. In the second half of the year, with China's economy continuing to improve and the risk of recession rising in Europe and the US, as well as the possibility of another directional change in the Fed's monetary policy, the RMB exchange rate is expected to emerge from a relatively strong trend. However, considering that there is still uncertainty about the development of the epidemic and the adjustment of monetary policies in major economies, coupled with the uncertainty about the direction of the evolution of geopolitical risks, it may lead to phase fluctuations in the RMB exchange rate. Overall, it is expected that the RMB exchange rate will maintain its oscillating and strong trend throughout the year and will end the year between 6.5-6.9.

Due to the continued interaction of the U.S. dollar and the U.S. debt, we advise our clients to settle in RMB to avoid exposure to short-term exchange rate instability of the U.S. dollar.