JWayfair reports first quarterly profit in four years

U.S. home furnishings e-commerce giant Wayfair recently announced that it returned to profitability in the second quarter, marking its first quarterly profit since the second quarter of 2021. The company reported a net profit of $15 million for the second quarter, compared to a loss of $42 million in the same period last year; operating profit was $17 million, compared to a loss of $35 million in the same period last year. Wayfair's net revenue increased by 5% year-over-year to $3.3 billion. Excluding the impact of exiting the German market, Wayfair's net revenue grew by 6%. U.S. market revenue increased by 5.3%, while international market revenue grew by 3.1%. However, the company's active customer count decreased by 4.5% compared to the same period last year. The number of orders per customer slightly increased from 1.85 to 1.86.

CEO Niraj Shah said Wayfair's second quarter was “a huge success” and noted that this period “was a strong validation of the path we are on, and what's even more exciting is the outlook for the future.” Despite ongoing challenges in the overall home furnishings market, Wayfair achieved its first quarterly profit in four years. Analyst Jonathan Matuszewski of consulting firm Jefferies noted that Wayfair has the potential to “significantly improve profit margins through sales growth.” Matuszewski stated in a report: “Imagine what could happen if the real estate market were to recover.” In recent years, retailers in the U.S. home goods industry have generally faced declining demand, but some retailers have recently seen sales rebound due to consumer concerns over tariffs and potential price increases. However, Wayfair executives stated last Monday that they have not yet observed significant changes in consumer purchasing behavior and praised the company's platform-based business model, which allows it to maintain relatively stable prices. He said: “The market resilience of our low-inventory platform model provides us with unparalleled flexibility, and the advantages of this model remain evident despite fluctuations in the macroeconomic environment.” He added that the prices of products currently purchased by consumers remain largely consistent with those of the previous

Wayfair's Chief Financial Officer, Kate Gulliver, stated during an analyst conference call: "We believe the current growth momentum is primarily driven by structural business reforms rather than one-time events, accelerated consumption, or similar factors. This momentum continues to persist. Wayfair's core competitive advantage lies in its ‘light-asset, high-SKU, platform-based’ business model, which has demonstrated exceptional resilience during the current cycle of elevated inventory risks and volatile price fluctuations. Wayfair's ‘marketplace platform’ model delivers cost advantages. Wayfair does not maintain large inventories but instead collaborates with thousands of suppliers through a ‘platform matching’ model. This not only reduces financial costs but also enhances product diversity.

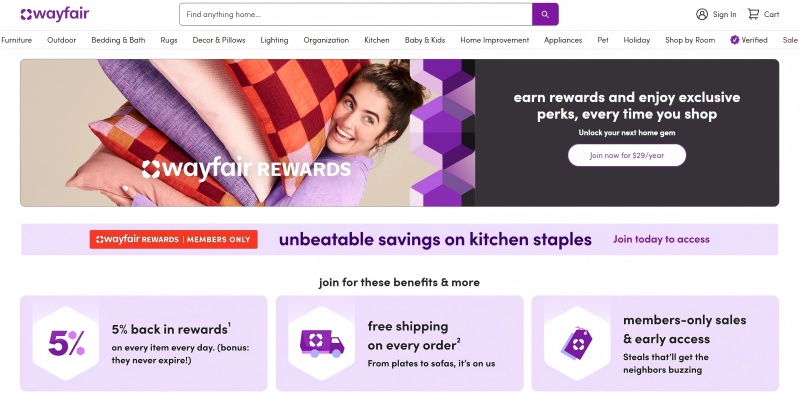

In recent months, Wayfair has launched several new initiatives, including the Wayfair Verified tool and a paid membership loyalty program. The in-house developed “Wayfair Verified” tool uses AI to assess product quality and description accuracy, thereby enhancing customer trust. By analyzing behavioral data and historical preferences, the tool recommends products to consumers while quickly adjusting pricing and inventory, enabling highly personalized marketing that helps boost conversion rates and average order value. Wayfair's paid membership loyalty program represents a significant strategic shift aimed at competing with Amazon Prime, with the goal of boosting repeat purchase rates. While the company's active user base has recently declined, order frequency has increased, indicating that customer loyalty is gradually strengthening. Moving forward, Wayfair can further enhance user lifetime value through initiatives such as “free shipping, member-exclusive discounts, and dedicated customer service.”

Additionally, a higher repurchase rate means that companies do not need to continuously invest in advertising to acquire customers, which will have a substantial positive impact on net profit performance. Wayfair is also continuing to expand its network of physical stores for its own brands. The company's first large-scale store opened approximately one year ago in the Wilmette area of Illinois (a suburb of Chicago), driving sales in categories that are typically purchased less frequently. Wayfair reported that purchases of low-priced items such as kitchen accessories increased by 50%, while purchases of home improvement categories like bathroom storage renovation products and kitchen storage cabinets rose by over 35%. Building on this momentum, Wayfair plans to expand its large-format store concept to regions such as Denver, Atlanta, and Yonkers.