Are Corporate Earnings Growth Inflated Amid U.S. Tariff Impacts?

One of the biggest challenges U.S. retailers will face this holiday season is how to conduct year-over-year performance comparisons amid tariff impacts.

Tariffs: A Realm of Uncertainty

"This is completely uncharted territory," Dana Telsey, CEO and Chief Research Officer of consulting firm Telsey Group, told the media. "Retailers have provided very broad ranges for price increases in their communications, and these hikes are not universally applied—only to select products."

Investors should not be surprised if companies are required to disclose the gap between "unit sales growth" and "revenue growth," Telsey noted. Many retailers may have sold fewer items, but revenue could still be "inflated" by tariff-driven price increases.

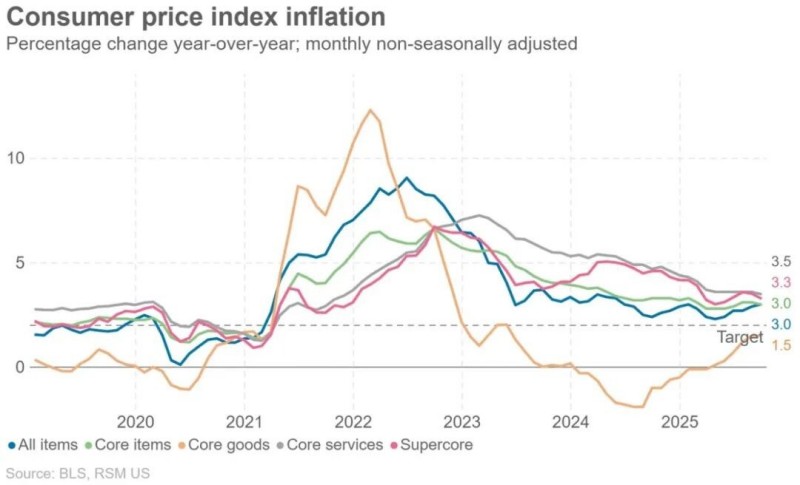

Take the September Consumer Price Index (CPI) as an example: despite tariff impacts, inflation remained at 3%, slightly below the Dow Jones consensus estimate of 3.1%.

Consumer Price Index Inflation: Percentage change year-over-year; monthly non-seasonally adjusted

Sources: BLS, RSM US

CPI, Policy, and Consumer Behavior

"CPI is essentially a cyclical indicator," said Oliver Chen, an analyst at consulting firm TD Cowen. "It is closely tied to the Federal Reserve's inflation-fighting policies, which in turn drive fluctuations in retail stock prices. But retailers and businesses are closely monitoring these issues now—because if we have to pay more for necessities, there will be less money left for non-essentials like TVs and sweaters."

"That's why analysts must ask about unit sales volumes, not just prices, during upcoming earnings calls," he added. "The key lies in how companies view price hikes. They anticipate consumers will buy less. Consumers are under significant pressure, and when prices rise, they purchase fewer items. Everyone bears the cost of these increases, and falling sales volumes will offset the benefits of higher prices. In other words, if you raise prices by 3% but sales volumes drop by 3%, the result is zero growth."

"This is why it's hard to say companies are truly benefiting from price hikes in the current environment," Chen emphasized.

Reassessing Financial Metrics

Lauren Murphy, General Manager of Retail Finance at Wells Fargo, stated that while revenue remains a core financial metric for the retail industry, it can be misleading in an inflationary environment. Revenue growth does not always reflect genuine improvements in performance.

"Combining revenue metrics with gross profit margins provides a clearer picture," Murphy said. "Gross profit margins reflect the impact of discounts, product costs, shipping, and tariffs, thereby revealing the true cost behind each dollar of revenue. Understanding this relationship is crucial for fair and accurate annual earnings comparisons."

"We expect upcoming quarterly and year-end results to show which retailers can maintain or protect their profit margins amid tariff pressures," she noted.

Chen also mentioned that companies like Costco and Walmart employ more strategic supply chain management—knowing which product categories they can sacrifice some profits in, or having the leverage to negotiate better prices with suppliers.

"For example, Walmart is well aware that consumers closely monitor egg prices," Chen said. "Companies are adopting different strategies: some are stockpiling in advance, while others are negotiating to lower costs. There is significant variation in each company's capabilities."

The Complexity of Performance Evaluation

As a result, evaluating performance in the next quarter— which includes holiday spending—will be particularly challenging.

"We are at a critical juncture: consumers are preparing to shop, but they will feel the impact of price hikes in more noticeable and distinct ways," Chen said. "I believe the situation will vary by product category and require specific analysis."

Retailers now also have stronger capabilities to identify which product categories are under greater price pressure.

Sean Henry, CEO of logistics company Stord, pointed out that this scenario is not entirely unfamiliar. Over the past five years, the retail industry has had to adjust its analytical methods multiple times to obtain accurate trend assessments.

"Over the past few years, multiple shocks to supply and demand—including the COVID-19 pandemic, international conflicts, and supply chain disruptions—have mostly been temporary," Henry said. "Therefore, it is crucial to exclude these short-term factors from analysis."

A Deloitte report also noted pandemic-related disruptions: "Comparing 2020 performance to 2019 is difficult due to the market collapse in early 2020, while comparing 2021 to the volatile 2020 creates a 'rebound effect' that exaggerates growth."

However, Henry warned that the impact of tariffs may be more enduring than these short-term shocks.

"We saw this when the Trump administration imposed tariffs on China under Section 301 during its first term—and these tariffs have been retained under the Biden administration," he said. "As a result, future annual spending comparisons will more accurately reflect consumers' actual disposable income levels and the new price realities."

To gain more granular insights, he added, one can compare the gap between retail spending growth and retail transaction volume growth to identify short-term tariff-related impacts.

"If the two continue to diverge, it indicates that total consumer spending has increased, but purchasing behavior has become more selective."

We also sell many products to US. The main products we sell are kitchen organizer series (Bathroom Laundry Storage Baskets, Modern Napkin Holder, Kitchen Organizers With Storage Drawer, Trolley Service Shelving Cart) tabletop series;home organizer series and bathroom series products.

In order to cope with the ever-changing foreign trade situation, our company constantly develops new customers and new products. With a positive and innovative attitude, we lead the industry in innovation.